As we approach the end of 2025, millions of Americans are facing a significant shift in health insurance costs. The enhanced subsidies under the Affordable Care Act (ACA), also known as Obamacare, are set to expire on December 31, 2025. This change could lead to dramatic premium increases in 2026, affecting middle-income families who rely on marketplace plans.

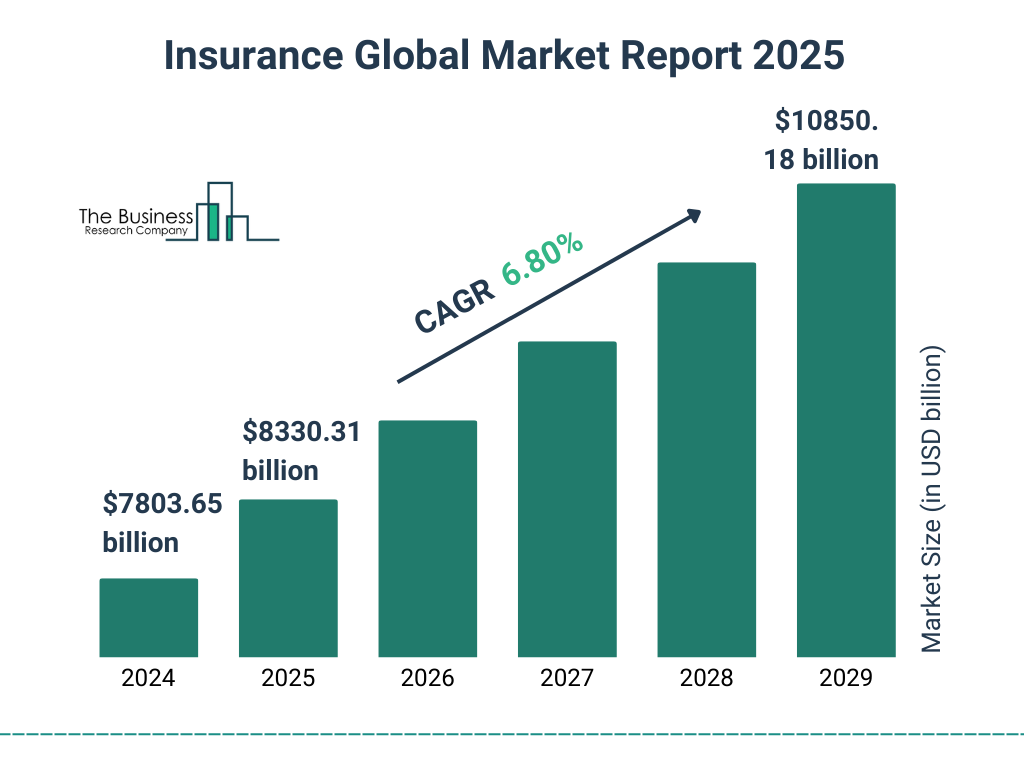

thebusinessresearchcompany.com

Why Are Health Insurance Premiums Rising in 2026?

The primary driver is the expiration of enhanced ACA tax credits, introduced during the pandemic to make coverage more affordable. Congress declined to extend these subsidies, leading to:

- Average premium increases of up to 114% when combined with insurer rate hikes.

- Monthly premiums potentially doubling from around $888 in 2025 to over $1,900 annually for some subsidized plans.

- Many enrollees, especially women who often manage family insurance decisions, reporting tough choices between coverage and essentials like food.

Recent reports from KFF and NPR highlight how these changes disproportionately impact middle-class families without employer-sponsored insurance.

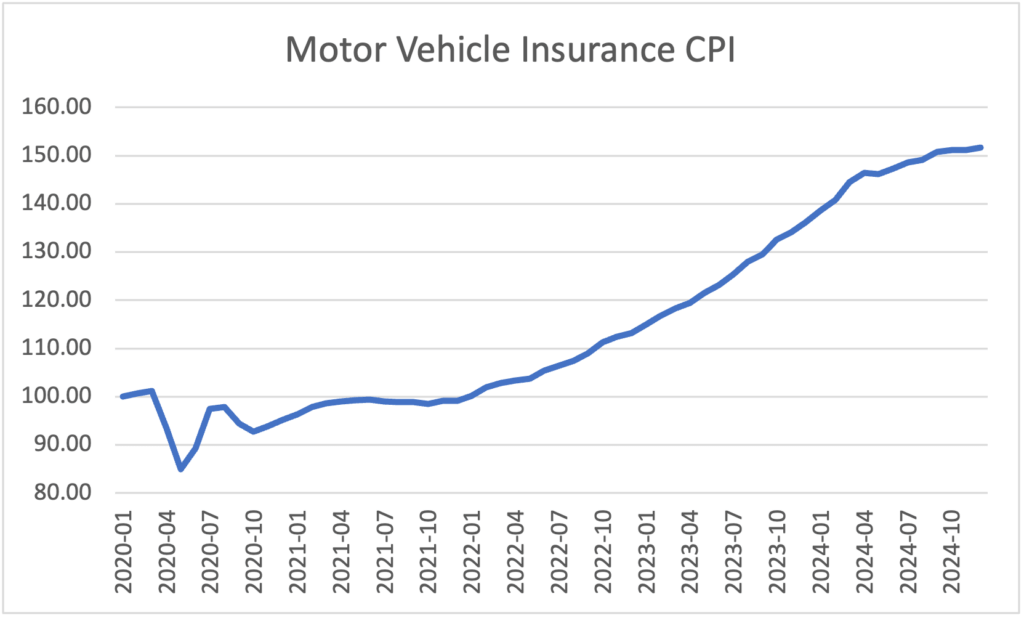

Impact on Auto and Home Insurance Rates

While health insurance grabs headlines, property and casualty lines are also evolving:

- Auto Insurance: Rate increases are slowing in 2025–2026 due to stabilizing claims costs, but prior years saw sharp rises from inflation and supply chain issues.

- Home Insurance: Climate-related risks continue to drive premiums higher, with insurers withdrawing from high-risk areas like California and Florida. Natural catastrophe losses are projected to exceed $100 billion again.

Key Insurance Industry Trends for 2026

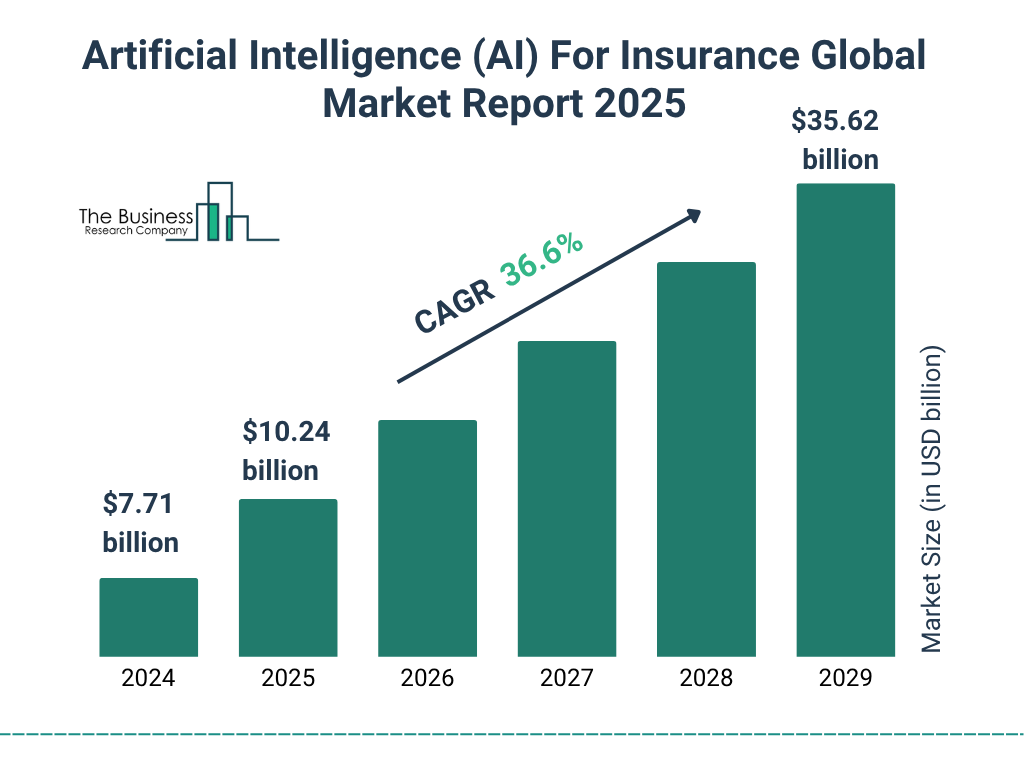

Looking ahead, the insurance landscape is transforming with technology and new risks:

- AI Integration: Insurers like State Farm, USAA, and Allstate lead in AI patents, focusing on claims processing, customer service, and fraud detection. Generative AI is surging.

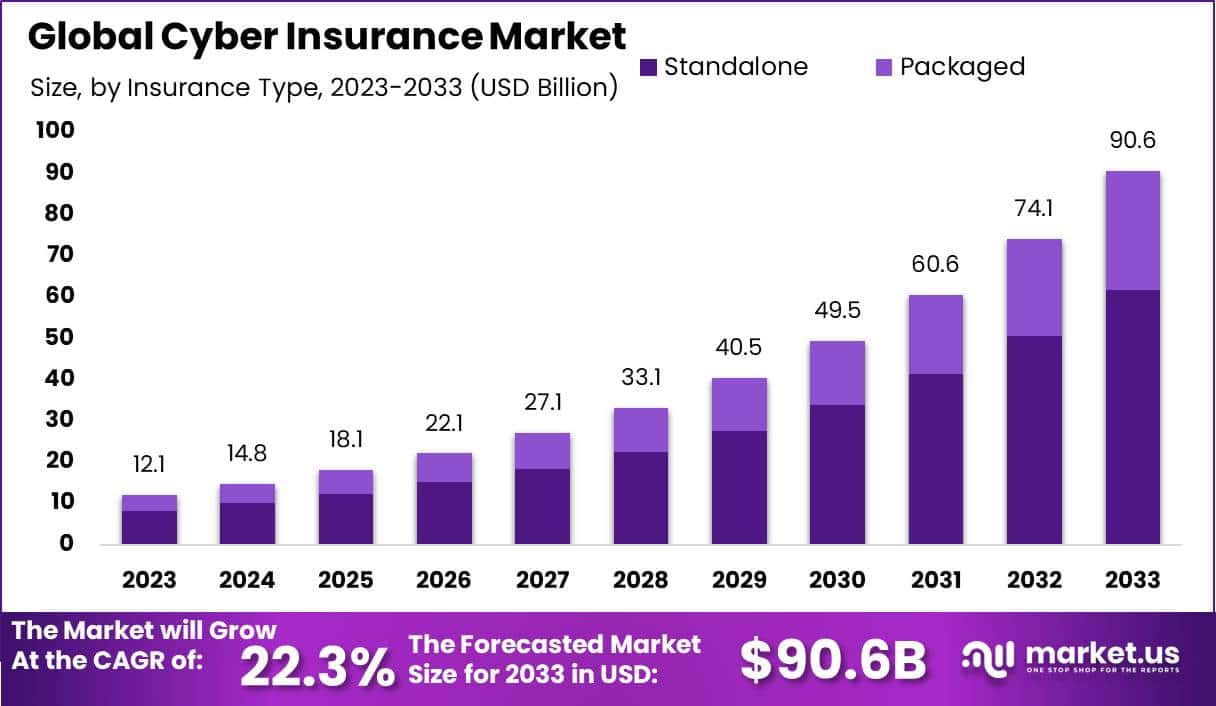

- Cyber Insurance Growth: Demand is rising amid increasing breaches, with profitability returning to the market.

- Embedded Insurance and Ecosystems: Partnerships are expanding coverage through digital platforms.

- Climate and NatCat Risks: Ongoing challenges with flooding, wildfires, and storms prompting alerts and policy reviews.

thebusinessresearchcompany.com

What Consumers Can Do Now

- Review Options Before Deadline: Many states extended open enrollment—check Healthcare.gov or your state marketplace.

- Explore Alternatives: Consider employer plans, Medicaid eligibility, or short-term options (with caveats).

- Shop and Compare: Use tools to find lower-cost plans or qualify for remaining subsidies.

- Plan for Increases: Budget for potential higher costs; some experts suggest retroactive relief could emerge.

- Stay Informed: Monitor legislative updates, as retroactive extensions or new policies may arise.

The Bigger Picture for Insurance in 2026

The end of enhanced ACA subsidies marks a pivotal moment, potentially increasing the uninsured rate and straining healthcare access. Meanwhile, innovation in AI, cyber coverage, and risk management offers opportunities for more efficient, personalized insurance.

Whether you’re dealing with health insurance premiums 2026, auto rate changes, or home coverage amid climate risks, staying proactive is key. Consult a licensed broker or visit official resources for personalized advice.

This shift underscores the need for affordable, accessible coverage—act now to secure the best options for your family.